Partnerships prevail at HICAP 2025

- GAS

- Oct 29, 2025

- 3 min read

Updated: Oct 30, 2025

Global Asset Solutions’ CCO Leanne Reddie reports from HICAP, where the power of personal connection was driving the region’s recovery

HICAP’s Singapore setting was particularly symbolic for a discussion about the future of hospitality in Asia Pacific.

The city, repeatedly referenced during the event as a model of resilience and innovation, has reclaimed its title as the region’s event powerhouse, hosting large-scale spectacles like Formula One.

This confidence has translated into performance: hotel revenues had climbed steadily from 2023 to 2025, with Marina Bay hotels surpassing $1,100 per night on peak event weekends. Despite global headwinds, the luxury segment here seemed unshakeable.

From there, the conversation moved beyond Singapore to explore investment currents across the region. Vietnam was highlighted as the rising star. Its coastal destinations were now dotted with cranes and hotel foundations and investors praised the country’s growing infrastructure and cost efficiency, which were helping to drive high operational returns.

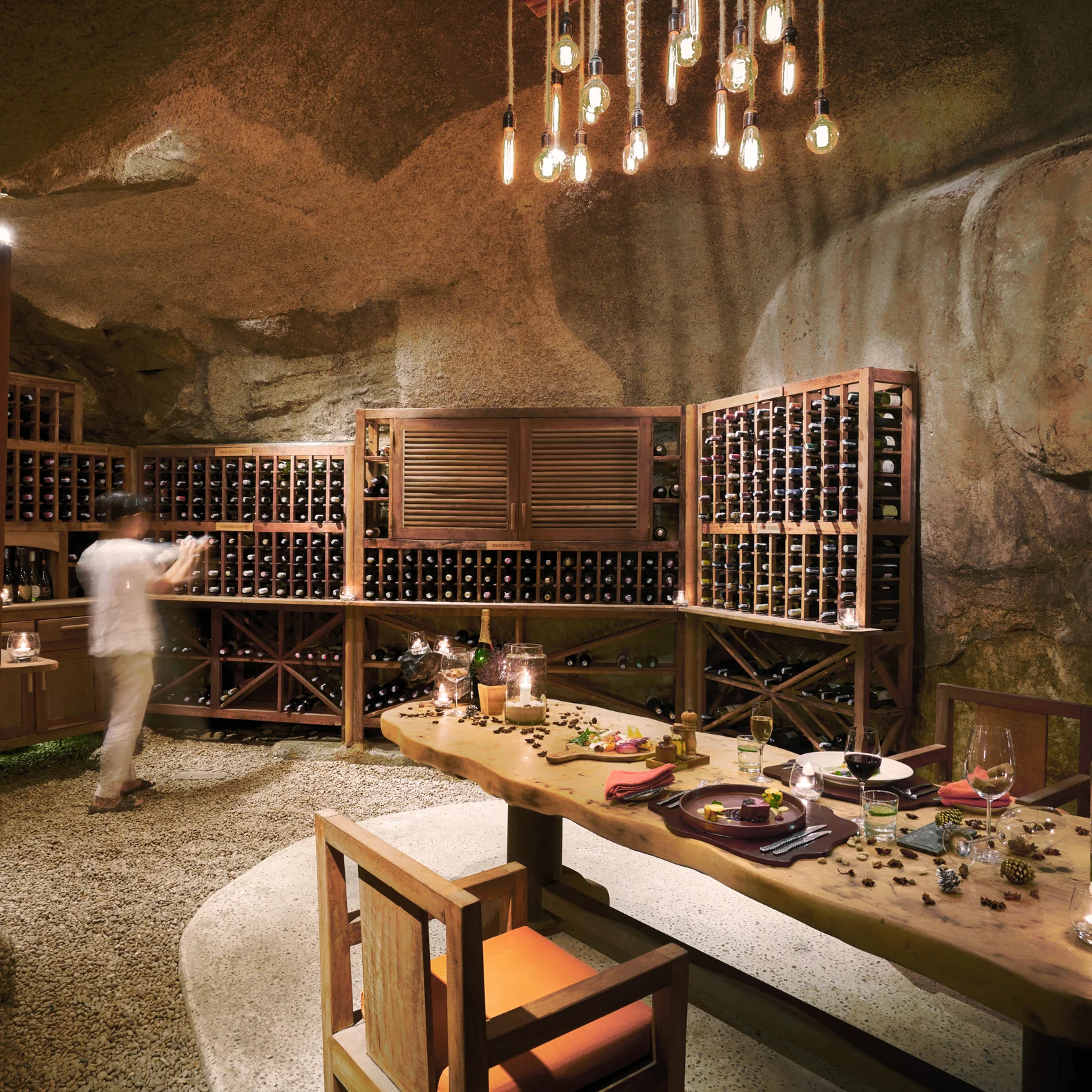

Forecasts suggested that Vietnam’s hotel supply would continue expanding rapidly through 2027, especially in developments emphasising food and beverage experiences.

In contrast, Thailand presented a more complex picture. While some urban markets faced economic strain and rising household debt, resort destinations such as Phuket and Koh Samui thrived, buoyed by international demand. Rates there were climbing, but no one expected dramatic spikes—just slow, steady progress.

Japan continued to draw private equity firms attracted to fast turnaround opportunities. Japanese hotels, particularly in regional cities, offered strong operational discipline and attractive margins despite rising costs. Food inflation had become a significant pressure point, pushing hotel operators to raise rates, yet demand remained solid in iconic destinations.

India, meanwhile, was described as a market in motion. Fuelled by massive infrastructure development and a growing domestic travel base, the country’s hotel industry was surging beyond traditional hubs like Mumbai and Delhi. Investors spoke enthusiastically about opportunities in second- and even fourth-tier cities where rapid rate growth signalled an untapped wave of expansion.

The Maldives’ luxury resorts continued to dominate investor interest, but questions lingered about sustainability and accessibility. High costs remained a barrier, but some panelists speculated that a new era of “affordable luxury” in the Indian Ocean might not be far away.

Australia rounded out the discussion as one of the region’s safest long-term bets. With strong domestic demand and a stable economy, the country continued to draw global brands. Brisbane, in particular, was riding a wave of development momentum as the 2032 Olympics approached.

China offered pockets of optimism. While corporate travel remained below pre-pandemic levels, mid-scale hotels benefited from growing domestic travel. Shenzhen stood out as a success story, and analysts projected a gradual recovery as international visitation and state owned enterprise travel picked up.

Running through all these market updates was a broader narrative about shifting global realities. Supply growth across Asia-Pacific was uneven, and 2026 was expected to be a slower year before supply pipelines matured in 2027. Investors spoke about rising concerns around sustainability and seasonality, both of which were changing how hotels operated. The volatility of food and beverage profitability came up repeatedly, sparking debate over whether hotels should rethink their approach to restaurants and bars altogether. Other markets, such as Malaysia and the Philippines, were seen as having potential but limited by a lack of direct air connectivity from major traveler sources like India and China.

Three legends of Asian hospitality—William E. Heinecke, Anil Thadani and Miguel Ko—took the stage to reflect not on financial success, but on relationships. For them, the hotel business had always been, at its core, about people. They spoke about partnerships built over decades, of trust formed across boardrooms and construction sites, of friendships that became the foundation of their companies. Their stories reminded the audience that hospitality was more than real estate and revenue projections.